39# Breakout Weekly Strategy Trading System

Submit by Ozzy Trader 26/01/2012

SETTINGS:

Pair: GBP/USD

Timeframe: 4 hour

Indicators: ATR (14) on the WEEKLY chart, or use the attached indicator on your

4H chart.

THE STRATEGY

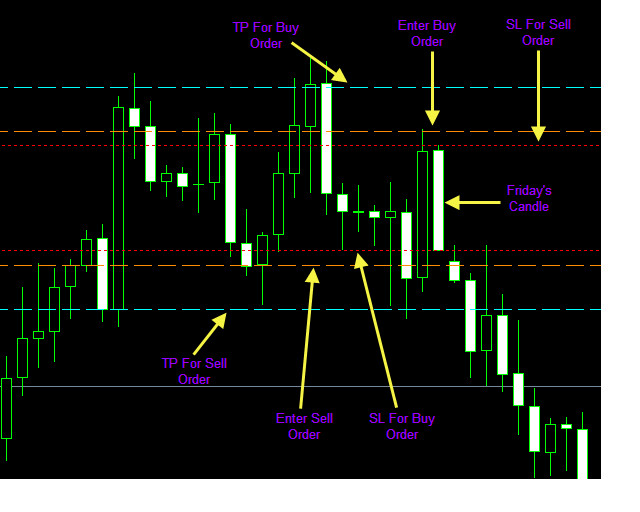

With the start of the trading week on Monday, find the Friday candle.

On a 4H chart find the high and low of the Friday candle.

Entry:

- Set BUY STOP order 10 pips above the high.

- Set SELL STOP order 10 pips below the low.

SL:

- For long trades the SL is the Friday candle low.

- For short trades the SL is the Friday candle high.

- Set SL to break even once your profit has reached 2x your SL.

So if the SL is 32 pips, you should set trailing stop of 64 pips.

TP:

- Your TP is the weekly ATR (14) Value (every 1000 = 10 pips).

Cancel Orders:

- You should cancel one order or both orders if one of the following happened:

o If none of the trades was taken until the end of the US session at the Next

Trading Day.

o If one of the trades was taken and reach his TP – cancel the 2nd order.

o If one of the trades was taken and the trade is in break even – cancel the

2nd order.

Don't get scarred from the example above, it's actually very simple.

Once we have found the Friday's candle, we set one buy stop order 10 pips above the

candle high and one sell stop order 10 pips below (Magenta lines).

For the buy stop order we set the SL at the candle's low and for the sell stop order we

set the SL at the candle's high (Red dotted lines).

For the buy stop order we set the TP like the Weekly ATR(14) value, same for the sell

stop order (light blue lines) – the Weekly ATR(14) value was about 3100 so it's 31

pips of TP.

Share your opinion, can help everyone to understand the forex strategy.