27# Fx Bolt Trading System

Submit by Alexander

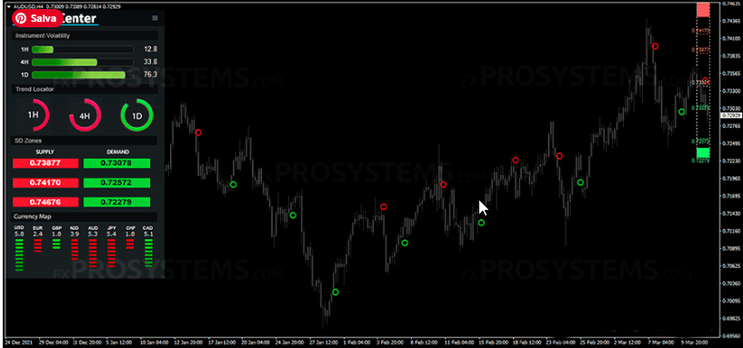

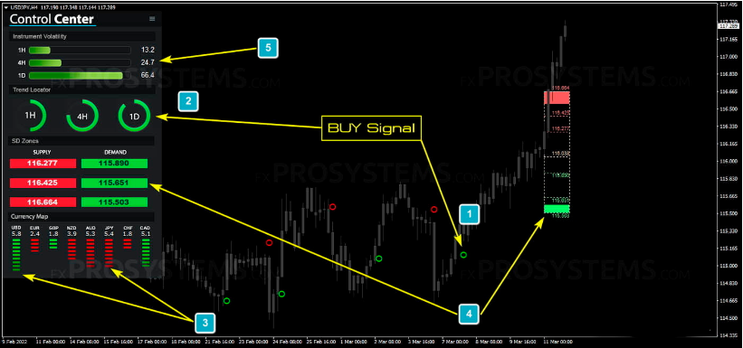

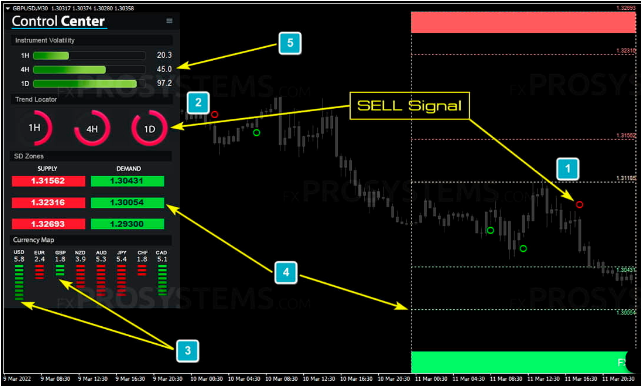

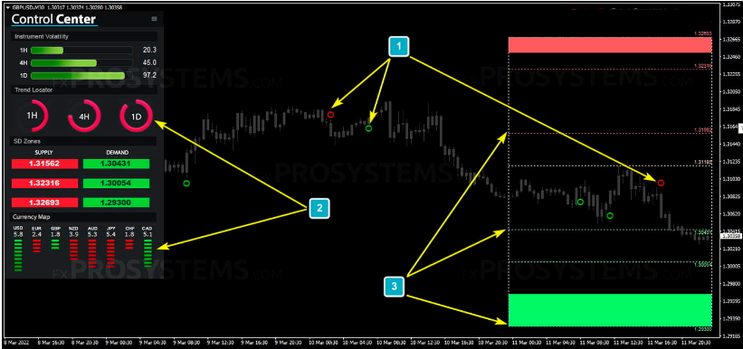

The FX Bolt trading system is a structured and reliable strategy that leverages a combination of three key components: an entry indicator, a filter indicator, and support/resistance levels. It is compatible with any trading style—scalping, day trading, or swing trading—and works across all timeframes and currency pairs, though the Major pairs and trading sessions in London and New York are recommended.

Key Components

-

Entry Indicator: Provides the initial signal to enter a trade.

-

Filter Indicator: Confirms the trend direction and supports the entry decision.

-

Support/Resistance Levels: Assist in determining optimal Take Profit (TP) and Stop Loss (SL) points.

Trading Setup

-

Platform: MetaTrader4

-

Currency Pairs: Any, but major currency pairs (e.g., EUR/USD, GBP/USD) are recommended.

-

Timeframes: Any, though signals align better on higher timeframes such as H1, H4, and D1.

-

Recommended Brokers: Roboforex, XM, FTMO.

Main Signal Components

-

BUY Signal:

-

Entry Dot: Green.

-

MTF (Multi-Timeframe) Confirmation: The three higher timeframes (H1, H4, D1) should also show a green trend.

-

Once the green dot appears and all higher timeframes are aligned, this is a valid BUY signal.

-

-

SELL Signal:

-

Entry Dot: Red.

-

MTF Confirmation: The three higher timeframes (H1, H4, D1) should show a red trend.

-

A red dot, along with confirmation from higher timeframes, signals a valid SELL opportunity.

-

Additional Confirmation for More Accurate Entries

Using extra confirmations will increase the accuracy and precision of your trades:

-

Currency Strength and Weakness Analysis: Analyze the strength or weakness of the currency you're trading to ensure you're on the right side of the market. For example, if you plan to BUY EUR/USD, ensure that EUR is strong and USD is weak compared to other currencies.

-

Supply/Demand Levels: Similar to support and resistance levels, these help in setting your Take Profit and Stop Loss. Take Profit should be placed at the next Demand level, while Stop Loss should be positioned at the nearest Supply level.

-

Pair Volatility: FX Bolt provides data on the volatility of the currency pair across different timeframes. Higher volatility means larger price movements, which can signal stronger trends, while low volatility may suggest a ranging or sideways market.

Signal Alerts

FX Bolt comes equipped with an advanced notification system that can alert you to potential trading opportunities in real time. Alerts can be set up via:

-

Pop-up Notifications on the trading platform.

-

Mobile Notifications for alerts on your phone.

-

Email Alerts to keep you updated even when you're away from the platform.

Risk Management and Best Practices

-

Always wait for full confirmation (entry dot + MTF alignment) before entering a trade.

-

Use the Supply/Demand levels to set conservative Stop Loss and Take Profit points.

-

Consider Currency Strength Analysis to avoid trading in low-liquidity environments or during periods of weak market movements.

-

Pair volatility helps to avoid trades in low-volatility periods, which may lead to flat markets and false signals.

By following this structured strategy, traders can maximize their chances of success while minimizing unnecessary risks.

Support and Resistance Forex Strategies

4# Simple Support and Resistance Strategy - Forex Strategies ...

36# Tutorial Support and Resistance - Forex Strategies - Forex ...

5# Support and Resistance important or psycho level - Forex ...

23# Fibnacci Support and Resistence - Forex Strategies - Forex ...

12# SRDC Method Level III - Forex Strategies - Forex Resources ...

9# SRDC Method Level I - Forex Strategies - Forex Resources ...

11# SRDC Method Level II with Fibo - Forex Strategies - Forex ...

8# Fibonacci Fan - Forex Strategies - Forex Resources - Forex ...

37# Trade Zone Tutorial - Forex Strategies - Forex Resources ...

Write a comment