467# Countertrend forex trading with TD SEQUENTIAL

TD Sequential indicator

A tool for identifying the ends of trends TD Sequential

Written by TOM DEMARK AND ROCKE DEMARK , Another example by Maximo Trader 31/07/2013

TD Sequential is designed specifically to predict potential price exhaustion and likely price reversals. This methodology is designed to become progressively less bearish as price declines and, conversely, less bullish as price advances, contradicting the behavior of most trend-following

traders. TD Sequential provides much-needed discipline and removes the emotions associated with trend trading. It also gives a distinct edge to traders who operate in size, allowing them to buy

when supply is most plentiful and to sell when demand is most aggressive.

Markets move in impulses or waves. No move, either up or down, is uninterrupted.

There is a natural rhythm or cadence associated with price movement in any market. This is apparent on any time frame, from one-minute to monthly. This rhythm can be measured

and followed according to the tenets ofTD Sequential, which has two components:

-

TD Setup, which is momentum- based and compares the closing price with the close four periods earlierand,

-

2) TD Countdown, which is trendbasedand compares the close with thehigh or low two periods earlier.

Buy and sell Setups

Buy Setup is a series of at least nine consecutive closes less than the close four price bars earlier. Prior to the first bar of this series, proper “initialization” must occur in the form of a TD

Price Flip. This means the close prior to setup close No. 1 must be greater than or equal to the close four price bars earlier; only then can the buy Setup process begin. (Note: For cash currency markets, use the New York close, which is 10 p.m. London time, asthe end of the trading day.) Once a minimum of nine consecutive closes less than the corresponding closes four price bars earlier are fulfilled, these bars are numbered 1 through 9. If that series is interrupted at any time prior to completion, the count is erased and the process must begin anew.

Typically, when a buy Setup is completed and “perfected,” price has a tendency

to at least react to the upside or move sideways –– i.e., after a confirmed

Setup, the prevailing downtrend corrects for a period of time. To “perfect” a buy setup, either the low of Setup bar 8, the low of Setup bar 9 or a subsequent price bar’s low must be

less than the lows of both Setup bars 6 and 7. Until that occurs, the anticipated price “hiccup,” or reaction, is less likely to occur. Asell Setup is a series of at least nine consecutive closes greater than the close four price bars earlier. Prior to the first bar of this series, a TD Price Flip must occur to initialize the Setup –– i.e., the close of the bar immediately before bar No. 1 of the prospective sell Setup must be less than or equal to the close four price bars earlier. If the Setup

series is interrupted at any time prior to completion, the bar numbers are erased and the process must start again.

Typically, when a sell Setup is completed and perfected, price has a tendency

to at least react to the downside or move sideways for a while. A sell

Setup is perfected when either the high of Setup bar 8, the high of Setup bar 9 ora subsequent price bar’s high is greaterthan the highs of both Setup bars 6 and

7. Until that occurs, the anticipated price reaction is less probable.

Countdown

Buy Countdown begins when a buy Setup has completed (once the minimum requirement of nine consecutive closes less than the close four days earlier is fulfilled). Beginning on the ninth

Setup bar, a process is applied that compares the close of that price bar vs. the low two bars earlier: If the close is less than or equal to the low two price bars earlier, then a Countdown is recorded. Just as a buy Setup series’ bars are numbered, so too are bars in a Countdown, except in a different color. Once 13 valid Countdown bars have occurred (note: Countdown bars do not have to be consecutive), the downside price momentum is likely to be exhausted. Additionally, to ensure the price action is sufficiently low relative to the prior price action, the following qualifier is used: The low of buy Countdown bar 13 must be less than or equal to the close of Countdown bar

8.

There are two events that cancel a buy Countdown prior to completion:the application of TD Sequential to cash currency trading.

Figure 1 of the cash British pound (GBP/USD) shows a sell

Setup series (green numbers) that completed in late May 2004; the red arrow above the “9” indicates the sell Setup was “perfected.” Notice the upside progress was interrupted for 11 trading days after this bar, as price moved sideways and then declined. The Countdown process then began, with the qualifying bars labeled with red numbers. The peak of the rally was marked by a Countdown “13” and exhausted the upside for this market. Notice another sell Setup developed simultaneously with this Countdown (the second series of green numbers, below the red Countdown numbers). This sell Setup was not perfected until the high close (day 12 of the Countdown) because days 8 and 9 of the sell Setup were below Setup day 7, and the high of Setup day 7 was not exceeded until two days after the sell Setup day 9, which happened to be the Countdown “12” day, and the highest close of the rally.

In late July a buy Setup was perfected on day 8; a short-term rally ensued, followed by a buy Countdown. Note the Countdown 12 bar appeared in mid September, followed by five asterisks before the Countdown 13 bar occurred. Each asterisk day would have been a “13,” but that designation was deferred because the lows of these bars were not as low or lower than the close of Countdown bar 8. Once a valid Countdown

13 bar occurred, however, downside pressure subsided and the market rallied.

Figure 2 of the euro/U.S. Dollar (EUR/USD) illustrates a sell Countdown in early January and a buy Countdown in mid-May. Although both Countdown 13s marked trend

reversals, price tested the 13 price level in each instance and then recorded secondary Setup 9 series. Both Setup 9 series were perfected, which served to reinforce the original 13’s.

Also, the Setup 9/Countdown 13/Setup 9 series that completed at the late-July bottom was particularly interesting because it defied conventional technical wisdom, which at that point interpreted the trend as bearish on the daily, weekly and monthly time frames.

In October, another perfected Setup 9 appeared that stalled the uptrend for a few days, after which the market entered the Countdown process.

In Figure 3 of the Australian dollar/ New Zealand dollar cross rate (AUD/NZD), four of the five Setup series have arrows that coincide with either a short-term price reversal or price consolidation. The two Countdown 13 bottoms had immediate upside price responses that proved tobe profitable moves. Forecasting trends instead of following them The advantage of using TD Sequential instead of conventional trend-following methods is that you can buy into weakness and sell into strength (and do so in size). When following trends, entry competition produces slippage and price gaps that cut into performance.

Operating against the trend is often difficult because it contradicts human nature. However, these examples showthere are distinct advantages to doing so, and TD Sequential is an indicator designed specifically to accomplish this goal.

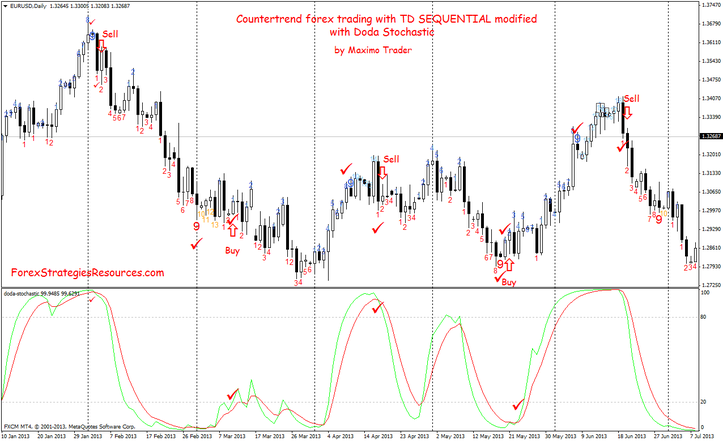

Countertrend forex trading with TD SEQUENTIAL modified with Doda Stochastic indicator

by Maximo trader

Time Frame 4h or daily

Currency pairs: ani

Doda stochastic indicator (setting 5-8-5 or default);

(note:Doda stochastic indicator is better than standard stochastic indicator).

Buy

When TDSequential count nine and after it count one in opposite direction, look doda stochastic indicator and wait that it crosses upward.

Sell

When TDSequential count nine and after count one in opposite direction, look doda stochastic indicator and wait that it crosses downward.

Exit Position options:

Profit Target Predetermined or ratio 1.5 stop loss;

When Doda stocastic indicator crosses in opposite direction.

Initial Stop Loss on the previous swing

Looks the example:Countertrend forex trading with TD SEQUENTIAL modified with Doda Stochastic

Share your opinion, can help everyone to understand the forex strategy.

Tom Demark Forex Strategies

TD Sequential with Doda Stochastic Template and indicators

Forex Trading System Download

244# Tom DeMark Trading Strategies - Forex Strategies - Forex ...

2# Tom Demark FX system - Forex Strategies - Forex Resources

104# Tom De Mark Trend line Strategy - Forex Strategies - Forex ...

DeMark Metatrader Indicator - Forex Strategies - Forex Resources ...

14# DeMarK System - Forex Strategies - Forex Resources - Forex

Countertrend forex trading with TD Sequential

Countertrend forex System

Write a comment